Galleries vs. Independent Artists: Who Controls the Future of Fine Art?

How is one of the most rigid and traditional industries becoming more accessible?

The fine art market is changing fast.

In 2021, galleries and dealers accounted for 58% of global art sales. A year later in 2022, the gallery sector accounted for 47% of the total market. (Art Basel)

Many believe that the art market is in stasis; key elements of the art market such as buyer profiles, art type and the role of institutions have stayed the same since its establishment in the second half of the nineteenth century. But we believe the fine art market is undergoing a significant transformation, shifting from a gallery-dominated landscape to a more democratized environment where artists can engage directly with collectors.

Galleries: Market Makers in the Art World

Galleries have long been central to shaping the art market, serving as arbiters of taste, promoters of talent, and drivers of market trends. Their role as gatekeepers has historically influenced which artists succeed and how the value of art is perceived.

Curating Value and Access

Galleries determine what is considered valuable art by selectively curating exhibitions and collections that set artistic and cultural standards. Access to these spaces has traditionally been limited, favoring artists with elite networks or institutional backgrounds, thereby excluding many underrepresented talents. By controlling the supply of artworks and strategically setting prices, galleries create demand, ensuring exclusivity and value retention for their represented artists.

Establishing Reputations and Shaping Movements

Galleries have historically nurtured artists by providing financial and logistical support, enabling them to focus on their craft. They have also been pivotal in defining and promoting art movements, such as Cubism and Abstract Expressionism, giving rise to artists who have become household names. As intermediaries in international markets, galleries expand artists’ reach, often positioning them on a global stage.

The Rise of Independent Artists

In 2020, 87 percent of surveyed art buyers claimed to use Instagram to find new artists, whereas 48 percent of respondents stated the same in 2016.

Digital Disruption: Selling Directly To The Consumer

The advent of digital platforms and social media has disrupted this traditional structure. Online marketplaces such as Artsy have enabled artists to showcase and sell their creations directly to a global audience, bypassing the traditional gallery system. Social media platforms, notably Instagram and TikTok, have become vital tools for artists to build their brands, connect with fans, and sell their work.

Digital Art and Technology: A New Era

The NFT boom of 2021 may have been a fleeting craze, but it marked the emergence of a significant art movement. Like movements of the past, NFTs and generative digital art share defining characteristics: shared themes, a defined time period, reactions to prevailing norms, and a collective identity. NFTs focus on authenticity and ownership through blockchain, while generative art uses algorithms to redefine the creative process. Together, they challenge traditional notions of authorship, value, and the role of technology in art.

This movement gained momentum around 2020, fueled by platforms like OpenSea and Art Blocks and driven by cultural shifts during the pandemic. It bypassed traditional gatekeepers, democratizing the art market and allowing artists to directly engage with global audiences. The rise of thriving online communities and pioneers like Beeple and Tyler Hobbs has further solidified this as a pivotal shift in art history, blending creativity and technology in unprecedented ways.

By blending technology and creativity, this movement represents a pivotal shift in how art is produced, valued, and experienced in the digital age. At its peak in 2021 NFT sales volume was $25bn.

Fair Compensation and Smart Contracts

One of the most transformative elements of this digital era is smart contracts. Unlike traditional art resale systems—where artists in the UK, for example, are capped at claiming a small percentage of resale value (e.g., a maximum of £20,000 on a £5 million resale)—NFTs use blockchain technology to ensure artists receive royalties automatically on every resale.

This change represents a democratization of the art world, ensuring fair compensation and greater financial security for artists. It disrupts the old models of art sales and empowers independent artists to benefit more equitably from the long-term value of their work.

There are a huge number of success stories from independent artists and this number is growing. To highlight but a couple:

A former dentist turned artist, Shakeel gained fame for her striking digital collages featuring glitter and crystals, often blending surrealism and pop culture. Her work became viral on Instagram, where she cultivated a massive following. Brands like Swarovski and Emirates have since collaborated with her. Shakeel’s online presence and unique aesthetic helped her achieve global recognition without gallery representation.

A digital artist focused on meditative, minimalist works that blend technology and wellness. Kim created the "Mars House", the world’s first digital NFT home, which sold for over $500,000 in 2021. Kim utilized the NFT ecosystem and social media to establish herself as a pioneer in digital and immersive art.

The Early Beginnings of the AI generated Art Market

The market for AI-generated art is still developing, though interest is growing. The 2018 sale of Edmond de Belamy for $432,500 marked a high point, but subsequent auction activity has been inconsistent. However, 2023 has seen renewed interest, with works by artists like Sougwen Chung and Mario Klingemann attracting buyers.

According to Hiscox’ 2024 Art and AI Report; only 2% of traditional collectors have purchased AI art, but 29% might consider it. Among new collectors (less than three years), 7% have bought AI art, and 39% are open to it.

The Enduring Role of Galleries: Validation and Value

Despite these advancements, the fine art market differs from the music industry in that a gallery's reputation can significantly enhance an artwork's value. Galleries often provide validation and credibility, influencing collectors' perceptions and the market value of an artist's work. This dynamic means that, while direct-to-consumer sales are increasing, gallery representation still plays a crucial role in an artist's career trajectory.

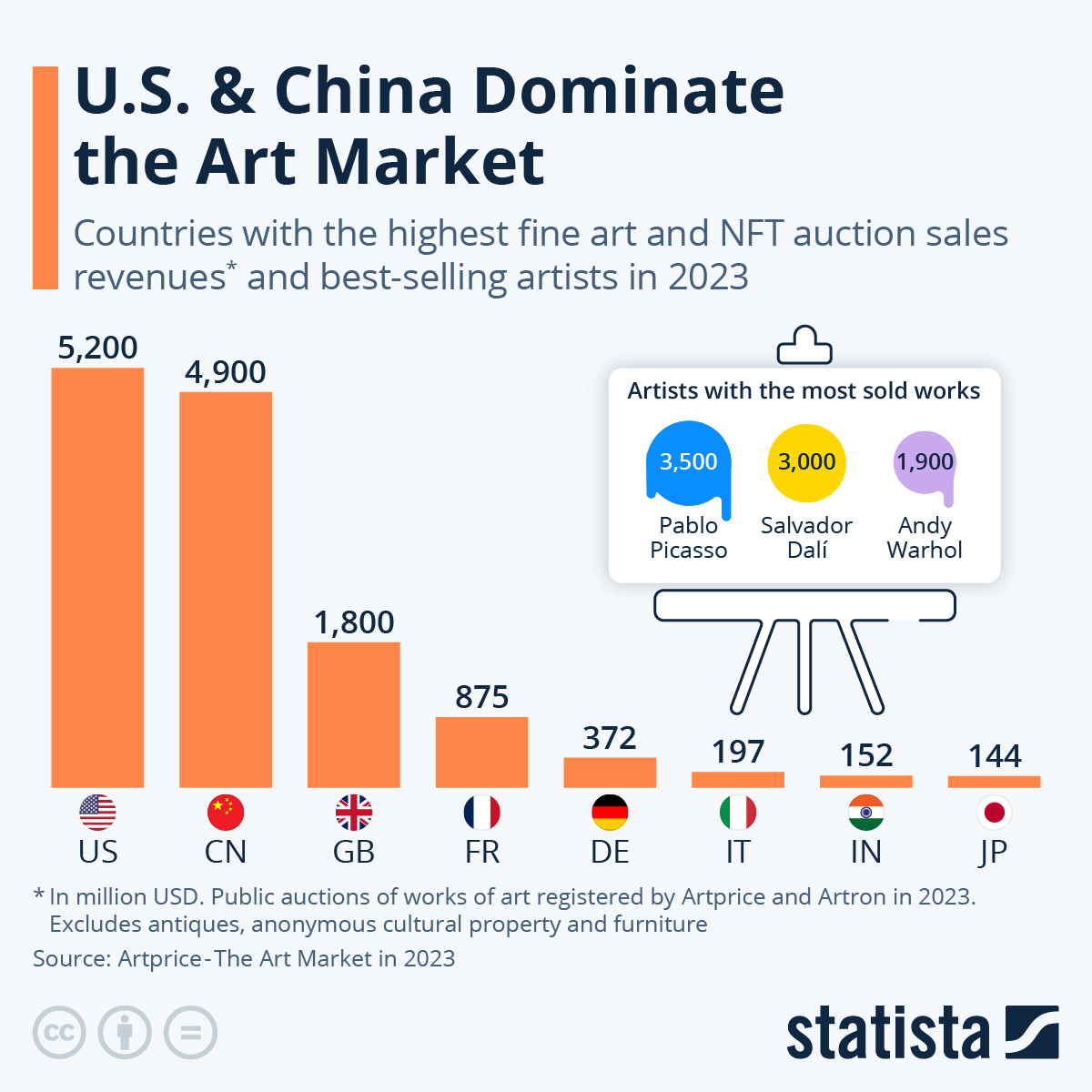

Meanwhile, the market’s geographic concentration has not changed much in the past decade. The majority of the sales in 2023 took place in the USA with 45%, followed by UK with 18%, and China with 17%, the latter of which fighting for the number two place over the years. In the last decade, sales from these three countries consistently make up 80-85% of global sales.

Challenges for Independent Artists

Independent artists navigating a gallery-free model face several hurdles. Managing social media and marketing demands can be time-consuming and detract from creative work. Meanwhile, the oversaturation of content on social media makes it difficult to stand out, and the algorithms that govern these platforms can be unpredictable, affecting visibility.

Financial instability is common due to inconsistent sales and the absence of institutional support such as stipends or residencies. Additionally, accessing high-net-worth collectors without the networks and credibility often provided by galleries remains a significant challenge, limiting opportunities for substantial sales and career growth.

Furthermore, not all artists have equal access to the resources and technology needed to effectively utilize these digital tools, leading to disparities in opportunities and success.

Venture Capital As a Catalyst For Change

Venture capital and startups have played a pivotal role in democratizing the fine art market by leveraging technology to make art more accessible to a broader audience. This influx of capital has enabled the development of platforms that cater to a wider audience, reducing barriers to entry for both artists and collectors.

However, the art market still lags behind in many dimensions to other industries in terms of full democratisation e.g Uber for transport and Airbnb for accommodation. To disrupt the art world, companies must:

Focus on the Middle Market: Expand beyond elite collectors.

Ensure Price Transparency: Offer clear pricing with multiple options.

Democratize Knowledge: Decentralize and grow the market by making information widely accessible.

However, the art market's slow pace of change may delay such a transformation compared to faster-moving consumer industries.

Balancing Innovation and Tradition in the Fine Art Market

In conclusion, while the fine art market is becoming more accessible, allowing artists greater control over their work and earnings, the traditional gallery system still holds significant influence. Integrating digital platforms offers new avenues for exposure and sales, but artists must navigate the accompanying challenges to fully benefit from these opportunities.

At New Renaissance Ventures, we are interested in technology based ventures that serve to democratise and disrupt the creative industries - including the visual art world.